4 Things You Need to Know About Buying Lingerie Internationally

The rise of online retail has given lingerie consumers a vast array of options that would've been unimaginable a decade ago. No longer limited by what's in stock at your local department store or neighborhood boutique, it's now possible to order lingerie from almost anyone who sells it... no matter where they happen to be.

The benefits of this brave, new world are obvious. Hard to find sizes now have dozens, if not hundreds, of options. Consumers who prefer to buy ethically can do so with ease. People with special needs, such as post-surgery or hypersensitivity attire, can find a brand that caters to that need.

Yet the world of online buying is not without its downsides. There's a different sort of risk in this transaction, including more opportunities for shady retailers and fly-by-night storefronts. Safe in the knowledge they'll not be held accountable, some brands and retailers engage in questionable business tactics, taking advantage of uninformed consumers.

I've been buying lingerie online for nearly a decade, and I'm still learning how to do it better. This list, while not exhaustive, is meant to share some of the most valuable things I've learned during that time.

Of course, this doesn't replace reading a store's terms and conditions on your own. It's still important to do your due diligence before buying. But I remember how intimidating buying internationally could be. So if you're in the same place, this is for you.

One last caveat: because I live in the United States, my perspective is weighted in the direction of a US-based consumer. I simply don't get things delivered to me anywhere else. But the principles here apply even if you live outside the States, and I hope you'll find them helpful no matter where you're located.

In a lot of ways, there's never been a more exciting time to be into lingerie. Get informed. Then go shop!

1) Currency Conversions

Often, when buying from a website outside your country of origin, you'll need to use their local currency. Google offers a quick currency converter within their search engine if you just type "currency converter" within the search bar.

Because of how the lingerie world is structured, I most often use pound and euro conversions while purchasing. You can also type that command into the search bar and get a direct answer (a phrase like "30 dollars to euros" is enough). Please note, however, that currency conversions change by the minute and the exact conversion rate won't be determined until the moment of purchase (it'll also be made by your bank). What Google offers is simply a useful and easily accessible tool.

Some websites let you convert to the currency of your choice directly on the page. At first, this may seem easier, but beware! Some companies set prices higher than the real conversion rates.

On Myla's website, for example, a bra on sale for £56.00 should, ideally, convert to around $85.00. Yet the price on Myla's US currency site is $185.00! That's an incredible (and completely unexplained) markup. Without double checking, a customer might assume Myla's conversion rate is accurate, but it is anything but.

Agent Provocateur has similar markups (a £95.00 Nicolle bra should convert to around $145, but instead sells for $190 on the US site), and even ASOS does it (a £39.00 Nubian Skin bra, which would convert to around $60, sells for $71).

I'm not saying you should avoid buying from places where there's a price conversion disparity. Some of that, especially on the low end (which is how I would define ASOS' $10 gap) can be explained away as a buffer against currency value fluctuations or a reflection of certain shipping and import taxes. It doesn't necessarily have to be nefarious. Perhaps even Myla has a good reason for their $100 pricing disparity. The point is simply to be an informed consumer so you can make informed decisions no matter what the price tag says. Hat tip goes to fellow lingerie blogger Marionette Mew for bringing this to my attention.

2) VAT Inclusion

VAT, or Value Added Tax, is something I primarily encounter when buying from the EU. I'm not a international tax professional, so I won't try to explain all the details (especially since US sales tax is a completely different beast), but the gist of it, for our purposes, is that European lingerie prices already include the tax... which should be deducted at checkout if you live outside the EU (Update: This rule applies primarily to medium- and large-sized businesses as small businesses beneath a certain revenue may opt out of VAT).

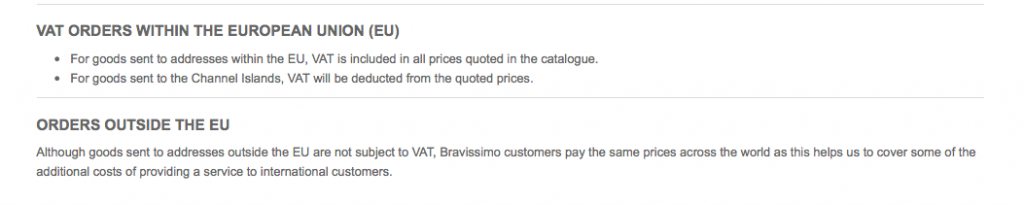

You've probably already guessed where I'm going with this: not every company deducts the VAT for international customers.

Holly's talked about Ewa Michalak as one European brand that keeps a 23% VAT in the final cost of their international orders, but they're not the only one. Bravissimo, another popular online retailer, also charges VAT to orders outside the EU. They say it's to cover "the additional costs of providing a service to international customers," but I'm not sure what is so time or labor intensive that it requires the equivalent of a 20% markup (the UK's current VAT rate) for people outside Europe.

If you're buying from a place that rolls taxes into the listed prices, always double check before completing checkout. If your total is unchanged, you may be paying VAT.

3. Shipping and Customs Duty

Going a bit further down the rabbit hole of international shopping, buying something from another country can mean dealing with expensive shipping fees and inconvenient customs taxes.

When I'm buying from a new online store, one of the first things I check is their shipping policies. What shipping method does the company use? Will you have to sign for it? What about insurance and tracking? What's your recourse if the item is lost? What can you do if the items are damaged?

More importantly, how will you feel if your order disappears off the face of the earth or arrives irretrievably ruined? Is the garment replaceable? Will you be able to write off the cost? Do you trust the seller to respond to issues? While the era of modern, trackable shipping certainly minimizes risk, negative outcomes are not unheard of. Think through the worst possible scenario and be prepared for it... just in case.

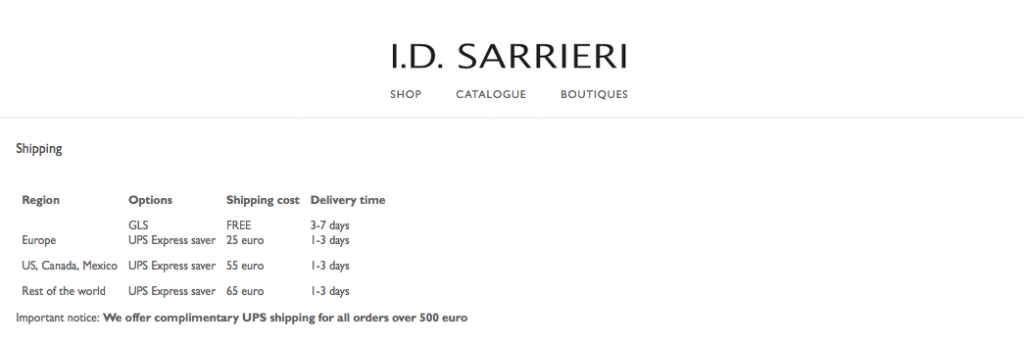

I.D. Sarrieri makes gorgeous lingerie, but it'll cost 55 euros (roughly $62) to ship it to North America. The upside is shipping fees are waived for orders of 500 euro or more.

When it comes to customs fees, if you don't know to expect them, they can be a rude surprise (especially if your package was held up by a customs delay). Different countries have different thresholds for when you'll be required to pay customs fees, so it's important to be familiar with the laws for where you reside.

In the United States, for example, the order threshold is $200 (Update: This threshold is now significantly higher. Check US Customs and Border Protection for the latest info.). That is the value of what you can buy and have delivered to you without being charged a tax. However, in Canada, the customs threshold is $20... which means paying a tax on most anything lingerie-related. The point is, when buying internationally, check your country's customs fees. For most places, this information should be publicly accessible from a government website.

One last note: reputable companies will not lie for you (such as calling an item a gift) so you can avoid paying customs fees. Falsifying customs documentation is a crime in most countries, and can have profound consequences - for both the business and your future ability to receive international shipments. Remember, customs fees are not an extra tax assessed by the merchant; they come entirely from the country where you're receiving the package. The seller has nothing to do with them.

4. Return Policies and Your Rights

Did you know you have 14 days from the date of delivery to return items purchased from the EU for any reason? Did you know you're entitled to a refund on any EU purchases if your order is not delivered within 30 days? Did you know your EU purchase is guaranteed for 2 years? I'm focusing on the EU because that's where a lot of lingerie comes from, and these consumer rights are guaranteed for international purchases from all EU member states (plus Iceland, Liechtenstein, and Norway).

While I encourage you to click on the links above for full details, what that means in real terms is you have two weeks to contact the seller, tell them you've changed your mind, and return the item. It also means you're entitled to a refund on any order that's been delayed/undelivered past 30 days. Finally, it means that if your item breaks or is otherwise faulty (for example, you received a size you didn't order or the underwire broke after only a few wears), you're entitled to a refund and/or return.

What this doesn't mean (especially for the 14-day return period) is that you can't use an item (for example, soiling and/or laundering it) and then return it for a refund. The 14-day period is meant to give you the ability to closely examine goods in person, comparable to when you view them in a shop. Please also note that this policy also doesn't apply to private sales from an individual; it's for companies only.

Of all the things mentioned so far, the EU's stance on consumer rights is probably the least well-known, but I believe it's the most important. Lingerie is a finicky beast, and it's not unusual to try multiple brands before finding the right one. While I haven't yet heard of a store declining a return within the allotted time period, this is still important information to have on-hand.

Outside the EU, things get a bit more complicated, and that's where reading the return policies of the site you're buying from becomes essential. There is no nationwide law on consumer returns in the United States, for example, and, depending on state law, a lingerie retailer may be well within their rights establish a final sale only policy. In Australia, a retailer is not required to give refunds if you change your mind, but may give one if the product is faulty. As with customs, it's impossible to make broad generalizations, but if you know what to look for, you can familiarize yourself with the rights of the country you're buying from.

What advice would you offer when it comes to buying lingerie online, especially if you're purchasing from a country not your own? Do you have any tried and true tips? Pitfalls to avoid? Please share your favorite recommendations in the comments!